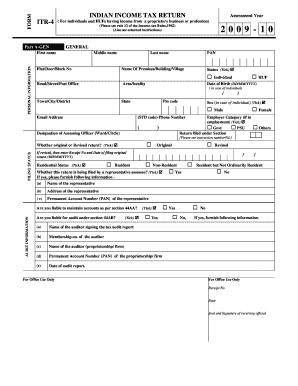

It is for those individuals who have selected a presumptive income scheme (PIC) under Sections 44AE, 44ADA, and 44AD of the Income Tax Act and has a business turnover of or less than INR 50 lakh. ITR 4 is one of the Indian income tax return forms.

However, it is always recommended to file your ITR on time to avoid any penalties or interest charges. Verify the ITR: After filing the ITR, you need to verify it using your Aadhaar card, net banking, or by sending a physical copy of the ITR-V to the Income Tax Department.īy following these steps, you can file ITR for the last three years. File the ITR: Once you have filled in all the details and paid any pending taxes, you can file the ITR for each of the three years online on the Income Tax Department’s website.ħ. You can pay the taxes online using the Income Tax Department’s website.Ħ. Pay any pending taxes: If you have any pending taxes for any of the three years, you need to pay them before filing the ITR. You can use an online tax calculator to compute your tax liability.ĥ. Compute the tax liability: After filling in all the details, you need to compute your tax liability for each of the years. Fill in the details: Once you have downloaded the ITR form, you need to fill in the details like your personal information, income details, deductions, and tax paid for each of the years.Ĥ. Download the relevant ITR form: You need to download the relevant ITR form for each of the three years from the Income Tax Department’s website.ģ.

Gather all the necessary documents: To file ITR for the last three years, you need to gather all the necessary documents like Form 16, Form 26AS, bank statements, and other documents related to your income and investments for each of the years.Ģ. Here are the steps you can follow to file ITR for the last three years:ġ. If you have not filed your Income Tax Return (ITR) for the last three years, you can still file it.

0 kommentar(er)

0 kommentar(er)